|

|

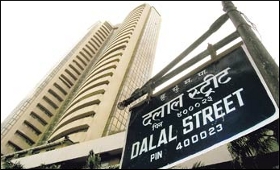

Markets end in green, Sensex closes 188 pts up

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 10 Apr, 2013

A benchmark index of the equities markets on Wednesday recovered by 188 points led by buying in blue-chips such as HDFC, Infosys and TCS, amid a firming global trend.

The 30-scrip sensitive index (Sensex) of the Bombay Stock Exchange (BSE) rose 187.97 points, or 1.03 per cent, to close at 18,414.45.

The index had lost 815 points in the last five session to trade at seven-month low.

In a volatile trade, the gauge had touched the day's low of 18,173.31 and a high of 19,461.44.

Similarly, the broad-based National Stock Exchange index Nifty spurted by 63.60 points, or 1.16 per cent, to 5,558.70, after dipping to 5,477.20.

In 30-BSE index components, 21 stocks gained led by Infosys, Reliance Industries, State Bank of India, ICICI Bank, HDFC Bank, HDFC Ltd, Larsen and Toubro, Bajaj Auto, Bharti Airtel and Cipla.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|