|

|

Effects of demonetization still persisting: Survey

|

|

|

|

| Top Stories |

|

|

|

|

Saurabh Gupta | 09 Nov, 2017

The effects of demonetization are still persisting as demand in the economy is still lacklustre and business firms are still not enthusiastic in production process said Anil Khaitan, President, PHD Chamber of Commerce and Industry in a press statement issued in New Delhi on Wednesday.

"Though demonetization of Rs. 500 and Rs. 1000 currency notes has completed one year today, the industries have still not recovered fully from the aftermath of unearthing 86 percent of the total currency," said Khaitan.

"We appreciate the efforts of the government to stamp out black money from the system, restrict terror funding, curb corruption, integrate informal economy into formal economy and to move towards less cash society," he said.

However, demonetization drive has impacted the businesses directly or indirectly in terms of impact on demand and sales. The impact of demonetization is majorly seen on small businesses as they are highly driven by cash transactions.

PHD Research Bureau, the Research Arm of PHD Chamber conducted a survey of 214 business firms covering 10 key sectors of the economy from MSMEs and large enterprises operating in different states to assess the impact of demonetization in the last one year.

The key sectors surveyed include Agro and food processing, Auto components & automotive, Construction & Real Estate, Drugs & pharmaceuticals, FMCG, Gems & Jewellery, Handloom and Handicrafts, Leather & leather products, Steel and tourism.

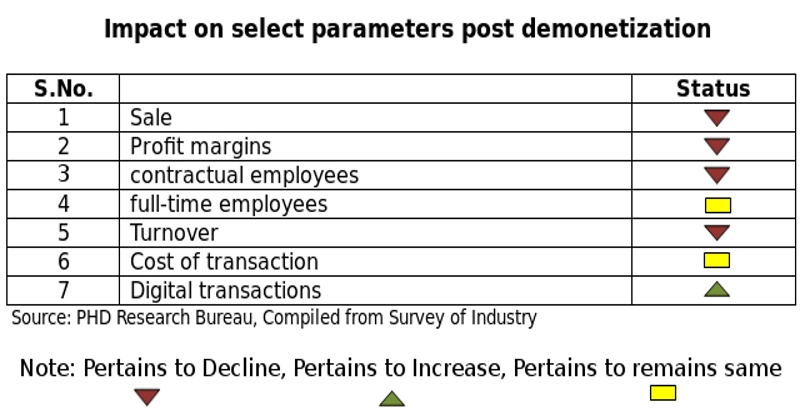

It has been observed that 65 percent of the firms across all the sectors surveyed have registered a decline in their sales post demonetization. Also, owing to less purchasing power, demand has not yet picked up fully in the economy.

The survey revealed that 61 percent of the business firms across all sectors have reported a decline in turnover post demonetization due to low production and lower demand.

Majority of the respondents (56 percent) have reported an increase in the transaction costs particularly at the time of implementation of demonetization due to delays involved in payments.

Further, the impact of demonetization has been more on contractual workforce than full time employees as the contractual primarily daily wage workers have to be paid in cash which had impacted their employment in almost all sectors surveyed.

Nonetheless, demonetization had a positive impact on the use of digital transactions as there has been a considerable increase (57 percent) as consumers prefer digital payments over cash post demonetization.

Going ahead, it is essential to revive demand to give a boost to industry thereby refuelling the economic growth to higher trajectory in the coming times.

"We look forward to revival of GDP growth in the coming quarters as anticipated at 6.7 percent (real GVA) for the current financial year 2017-18 by RBI in its latest fourth bi monthly monetary policy statement 2017-18 released on October 4, 2017," Khaitan added.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|