|

|

Is doing business in India really easier now?

|

|

|

|

| Top Stories |

|

|

|

|

Amit Kapoor | 14 Nov, 2017

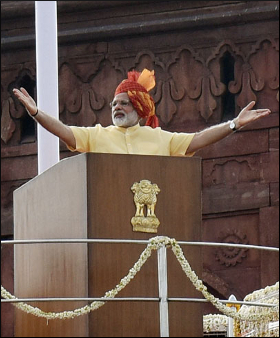

Prime Minister Narendra Modi's efforts in building India's global appeal

for investors seems to have finally yielded returns in terms of the

country's performance in the World Bank Doing Business rankings. India

witnessed its highest-ever jump of 30 places in the rankings, reaching

the 100th place among 190 countries. Subsequently, it also joined the

list of top 10 improvers for the first time and became the first South

Asian country to achieve the feat.

The World Bank measures this

in terms of a Distance to Frontier (DTF) metric, which shows the

distance of the economy from the best performer in each category on a

scale of 0 to 100, with the latter representing the frontier. India has

shown a drastic improvement of 4.71 points over the last year from 56.05

to 60.76. To put things in perspective, China has witnessed an increase

of 0.40 points.

India's performance has been impressive by any

standard. It has moved closer to the global standards in nine of the ten

parameters on which the Doing Business rankings are based and has

enforced reforms in eight of these categories over the last year. The

three key reforms among these were resolving insolvency, ease of paying

taxes online and protection of minority investors. Despite these

improvements, the general sentiment has been to dismiss the rankings

mainly for the flaws in its methodology.

First, the rankings are

based on perception surveys of few entrepreneurs or professionals based

on questions that are mostly subjective in nature. Second, they are not

even based on the economic conditions of the entire economy but on one

or two cities within a nation. For India, it is based on Delhi and

Mumbai alone. However, the critics miss the point.

If India

performs poorly even on such a limited study that chooses the best

cities in the country, it speaks volumes of the business conditions

across the country and is indicative of the scope of improvement that

remains. Moreover, rankings are relative by definition and since the

World Bank chooses a maximum of two cities for other countries as well,

it should depict a near accurate performance of any country on a

relative scale. Therefore, any improvement up the ladder cannot be

summarily dismissed.

Further, reforms considered by the World

Bank include a mix of central and state initiatives. Passing of central

legislation like the Insolvency and Bankruptcy Code, 2016, that helped

India jump from 136 to 103 in the "resolving insolvency" parameter have

pan-India benefits and are not just limited to Delhi and Mumbai.

Therefore, it would be incorrect to presume that merely focusing on a

few cities is disassociated from reality even though the actions of

state governments are not reflected.

Incidentally, India performs

poorly in parameters where state government interference is maximum:

Getting an electricity connection, starting a business and registering a

property. This underlines the importance of policy coordination between

the states and the Centre. Nevertheless, credit needs to be given where

it is due for an improvement in rankings majorly driven by reforms

undertaken by the central government over the last few years. It must be

noted that the rankings have not taken into account the implementation

of the Goods and Services Tax (GST). Therefore, considerable potential

remains for further improvement.

But it should also be kept in

mind that these rankings are not an end in themselves and are far from

perfect. A lot of it is based on policies which are on the books and do

not necessarily capture the real experiences on the ground. After

reforms are initiated to ease the business environment, the main task of

implementation begins where the real problems emerge. For instance, the

World Bank applauded India's efforts at increasing access to credit

with the adoption of a new insolvency and bankruptcy code. However, the

parameters fail to recognise the problem that India is going through one

of its slowest phases of credit growth and that banks are wary of

lending so easily.

Moreover, a lot more parameters, apart from

the ones considered in the Doing Business rankings, need to be

considered to understand the business environment in India. The

country's dismal performance in the Heritage Foundation's Index of

Economic Freedom (in which it is ranked 143, below most of its South

Asian neighbours) and Transparency International's Corruption Perception

Index (ranked 79th), reflect the areas that the country still needs to

improve upon to better the business environment.

Therefore, the

chest-thumping around the Doing Business ranking improvements needs to

be seen in conjunction with these factors and worked upon to ease the

problems faced by common businessmen. A premature celebration can be

counter-productive.

(Amit Kapoor is chair, Institute for

Competitiveness, India. The views expressed are personal. He can be

contacted at amit.kapoor@competitiveness.in and tweets@kautiliya. Chirag

Yadav, senior researcher, Institute for Competitiveness, India has

contributed to the article)

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|