|

|

Modi-led stable govt doesn't assure new bull market

|

|

|

|

| Top Stories |

|

|

|

|

Vatsal Srivastava | 03 Feb, 2014

Indian equities have witnessed a few choppy trading sessions following the US Federal Reserve's announcement to further taper its monthly bond buying program by USD 10 billion to USD 65 billion a month. The emerging market currency sell-off has also added to short term bearishness. But the stabilization of the Turkish lira and the South African rand in the latter half of last week will most likely lead to an improvement in trading sentiment in the emerging market space.

As the Nifty of India's National Stock Exchange (NSE) looks to find support around the 6,000-point level, the underlying mood still remains bullish with all major brokerage houses having year-end targets at 6,700-7,000 points - a further 10 percent upside from current levels.

The main catalyst for this rally would be what the majority of analysts on Dalal Street are calling the key event risk of 2014 - the spring general election. Recent results of state assembly elections and opinion polls are clearly indicative of wave in favour of Narendra Modi - the prime ministerial candidate of the Bharatiya Janata Party (BJP).

Foreign institutional investors are "overweight" on India largely based on the assumption that a stable coalition led by the BJP in majority will kick-start the investment cycle by introducing a host of pro-growth policy measures.

But what is the co-relation between political stability and positive economic outcomes? The economics research department of JP Morgan put out a note last week to analyze evidence of the past 20 years. This comment presents facts produced in the JP Morgan India special report, titled "5 Questions That Keep Us Awake' dated Jan 26.

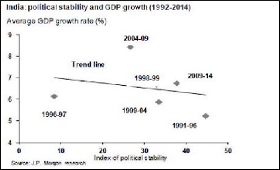

To address this question, the analysts created an index of political stability which is defined as the fraction of seats of the largest party in the ruling coalition vis-a-vis the total number of seats in the Lok Sabha. For example, if the party with the largest number of seats in a governing coalition was 200, the index is 200/543 (543 representing the number of elected seats in the Lok Sabha) or 0.37. Thus, the larger this ratio, the more politically stable the government is presumed to be.

JP Morgan's analysts found no positive co-relation between the index of political stability with three key macro-economic variables, such as rising GDP growth, lower wholesale inflation and lower fiscal deficit as a percentage of GDP between 1992-2014. As per conventional wisdom, we would expect the index of political stability to be positively correlated with growth.

Instead, their analysis shows more stable regimes are associated with lower growth over the last 20 years. The analysts decided to pick the early 1990s as a starting point because it represented a "structural break in the growth process as well as the time during which a host of regional parties emerged".

When the Indian average GDP growth rate for 1992-2014 is plotted against the index of political stability, we see the negative co-relation between the two variables as shown in the graph.

Further, as their analysis points out, both the Asian financial crisis in 1998 and the global financial crisis in 2008 occurred during regimes that scored relatively low on the index of stability. Thus, if one were to adjust and include the negative effects on growth of these external factors, the negative correlation would be even stronger.

Another possible explanation, according to the research was that perhaps stable regimes engage in more fiscal consolidation, and go after inflation more aggressively. That would explain the negative association with growth. But then, one would also expect to see political stability negative correlated with inflation and fiscal deficits.

But here, too, their analyses show that political stability is associated with higher fiscal deficits and higher inflation. Of course, the above-drawn results, using statistical analysis, are open for debate, and as the research itself suggests, they require a further detailed analysis by political pundits.

But as things stand today, the fact remains that market participants are bullish on Indian equities over the next year solely because of rising expectations of a Modi-led BJP at the center. Anyone looking to put their money in Indian stocks solely based on one future event should keep this analysis in mind.

**Vatsal Srivastava is a senior market analyst. The views expressed are personal.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|