|

|

|

|

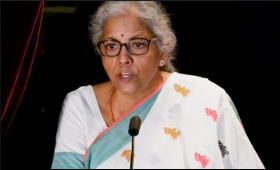

FM to meet public sector banks chiefs on March 25

|

|

|

|

| Top Stories |

|

|

|

|

IANS | 23 Mar, 2023

Amid the failure of banks in the US and the liquidity crisis being faced

by Credit Suisse, Finance Minister Nirmala Sitharaman is expected to

meet chiefs of public sector banks on March 25.

This

would be the first meeting of the Finance Minister with banks' chiefs

after the presentation of the budget, where, according to sources, the

discussion is likely to be on the areas highlighted by the budget.

Sitharaman is also likely to review the credit flow to key sectors like agriculture, sources in the know of things said.

The

meeting is also taking place amid growing concerns over monetary

tightening globally and is being held just days after the US Federal

Reserve on March 22 hiked interest rates by 25 basis points to tame high

inflation despite the banking crisis.

The meeting will also

review the targets achieved by state-owned banks set under various

government schemes, like the emergency credit line guarantee scheme,

Kisan credit card and Mudra Yojana among others.

The Finance Minister would also review non-performing assets, credit growth and asset quality among other issues, sources said.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is the biggest war impact on MSMEs? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|