|

|

|

|

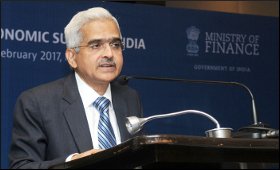

'India has well-regulated and well-supervised banking sector'

|

|

|

|

| Top Stories |

|

|

|

|

IANS | 17 Mar, 2023

Reserve Bank of India Governor Shaktikanta Das on Friday gave a thumbs

up to the country's banking system, while stressing how recent

developments in the US have brought to the fore the criticality of

banking sector regulation and supervision.

"What we have

in India today is a well-regulated and well-supervised banking sector.

The same would apply to the NBFCs sector and other financial entities

under the RBI's domain," he said while delivering the K.P. Hormis

Commemorative Lecture here.

Hormis was the founder of the Kerala-headquartered Federal Bank.

Das

pointed out that the focus is now more on identifying the root cause of

vulnerabilities, rather than dealing with the symptoms alone.

"We

have also issued revised guidelines on oversight and assurance

functions of financial entities. Use of advanced data analytics is

supplementing our supervisory process. To strengthen cyber resilience, a

comprehensive cyber security framework for banks together with Digital

Payment Security Control Guidelines have been issued. We have also

established the college of supervisors and augmented the staff strength

significantly in recent years," he said.

Das focussed on how the

recent developments in the US banking system have brought to the fore

the criticality of banking sector regulation and supervision.

"These

are areas which have significant impact on preserving financial

stability of every country. More specifically, these developments in the

US drive home the importance of ensuring prudent asset liability

management, robust risk management, and sustainable growth in

liabilities and assets; undertaking periodic stress tests; and building

up capital buffers for any unanticipated future stress.

"They

also bring out that crypto currencies/assets or the like, can be a real

danger to banks, whether directly or indirectly," he said.

"The

Reserve Bank has taken necessary steps in all these areas. The

regulation and supervision of the financial sector and the regulated

entities have been suitably strengthened. The regulatory steps include,

among other things, the implementation of leverage ratio (June 2019),

large exposures framework (June 2019), guidelines on governance in

commercial banks (April 2021), guidelines on securitisation of standard

assets (September 2021), scale-based regulatory (SBR) framework for

NBFCs (October 2021), revised regulatory framework for microfinance

(April 2022), Revised regulatory framework (July 2022) for Urban

Cooperative Banks (UCBs) and guidelines on digital lending (September

2022)," Das added.

On India's G20 presidency, Das pointed out

that this has come at a time when the country has once again emerged as

the fastest growing major economy in the world.

"International

confidence on India's capacity to contribute constructively to reshape

the global economic order is rising. The risk of a hard landing has

dissipated world over, even as the pace of disinflation remains less

than desirable. Before the cascading effects of geo-economic

fragmentation further dampen the global outlook, rebuilding trust

through cooperation and recommitting to multilateral frameworks for

addressing critical global challenges has become essential," he said.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|