|

|

|

|

'Calibrated monetary policy action warranted to contain inflation'

|

|

|

|

| Top Stories |

|

|

|

|

IANS | 24 Dec, 2022

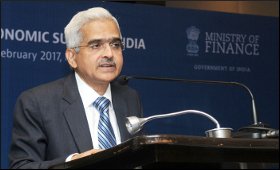

Saying that inflation remains above the upper tolerance level, Reserve

Bank of India (RBI) Governor Shaktikanta Das stated that calibrated

monetary policy action is warranted to contain build-up in underlying

inflationary pressures.

"Our successive rate actions

since May 2022 are working through the system. Considering the elevated

inflation levels, especially the stickiness in core inflation, further

calibrated monetary policy action is warranted to contain build-up in

underlying inflationary pressures, keep inflation expectations anchored,

and bring inflation closer to the target rate of 4 per cent over the

medium term. This would strengthen the medium-term growth prospects of

the Indian economy," said Das according to the minutes of the latest

monetary policy committee (MPC) meeting published recently.

The RBI Governor said that a premature pause in monetary policy action would be a costly policy error at this juncture.

"I

am, therefore, of the view that a premature pause in monetary policy

action would be a costly policy error at this juncture. Given the

uncertain outlook, it may engender a situation where we may find

ourselves striving to do a catch-up through stronger policy actions in

the subsequent meetings to ward-off accentuated inflationary pressures,"

he added.

Das said that in a tightening cycle, especially in a

world of high uncertainty, giving out explicit forward guidance on the

future path of monetary policy would be counterproductive and this may

result in the market and its participants overshooting the actual play

out of real conditions.

"In such circumstances, it would be

prudent to keep Arjuna's eye on the evolving inflation dynamics and be

ready to act as may be necessary. Monetary policy has to be nimble to

address any emerging risk to the price stability, while keeping in mind

the objective of growth," he added.

Shashanka Bhide, Senior

Advisor, National Council of Applied Economic Research, said that with

overall domestic growth showing signs of resilience, the adverse global

macroeconomic conditions require that domestic inflation rate is at

moderate levels, within the tolerance band of the inflation target on a

sustained basis.

"The persistence of core inflation at the upper

limit of the tolerance band of the inflation target is of particular

concern. Slippage on both growth and inflation objectives together would

be a poor outcome. Keeping in view the need to achieve moderation in

the inflationary pressures in a sustained manner, continuing with the

monetary policy tightening measures is necessary at this stage," he

added.

Michael Debabrata Patra, Deputy Governor in charge of

monetary policy, said that the longer inflation stays at current levels,

the greater is the danger of expectations getting unhinged, frittering

away the moderation reported in the most recent surveys of households,

businesses and professional forecasters.

"The risk of inflation

eroding purchasing power and weakening consumer spending, especially on

discretionary items, is becoming significant. Inflation expectations may

also be stalling private investment in capacity creation, as reflected

in corporate performance during the second quarter of 2022-23," he

added.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹88.70

|

₹87 |

UK Pound

|

₹119.90

|

₹116 |

Euro

|

₹104.25

|

₹100.65 |

| Japanese

Yen |

₹59.20 |

₹57.30 |

| As on 30 Oct, 2025 |

|

|

| Daily Poll |

|

|

| Who do you think will benefit more from the India - UK FTA in the long run?

|

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|