|

|

|

|

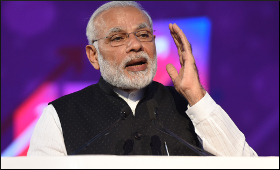

Recent reforms have made banks' financial health strong: PM

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 18 Nov, 2021

Prime Minister Narendra Modi on Thursday said that Centre's banking

reforms during the past six-to-seven years have supported the sector in

"every way".

Addressing a conference themed 'Creating Synergies

for Seamless Credit Flow and Economic Growth', he said these reforms

have improved banking sector's overall health, because of which it is in

a "very strong" position today.

"We addressed the problem of

'NPAs', recapitalised banks and increased their strength. We brought

reforms like IBC, reformed many laws and empowered debt recovery

tribunal. A dedicated 'Stressed Asset Management Vertical' was also

formed in the country during the Covid-19 period," he said.

"Indian

banks are strong enough to play a major role in imparting fresh energy

to the country's economy, for giving a big push and making India

self-reliant."

Addressing the gathering via video link, he said this is the time for the sector to support wealth creators and job creators.

"It

is the need of the hour that now the banks of India work proactively to

bolster the wealth sheet of the country along with their balance

sheets," he said.

Additionally, he mentioned that the steps taken in the recent past have created a strong capital base for the banks.

Furthermore,

he pointed out that banks' sufficient liquidity and no backlog for

provisioning of 'NPAs' -- which is at the lowest in the last five years,

have led to upgrading of outlook for the Indian banks by the

international agencies.

Also, banks have a crucial role to play

in making the recently announced production-linked incentive (PLI)

projects viable through their support and expertise, he added.

Recently,

'PLI' schemes were announced to incentivise select sectors in

increasing their capacity manifold and helping them become competitive

globally.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|