|

|

|

|

2 days after PM's meet, parl panel discusses crypto currency

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 15 Nov, 2021

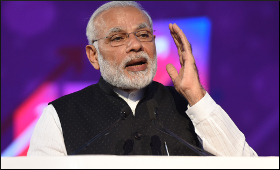

Two days after Prime Minister Narendra Modi chaired a high-level review

meeting in connection with crypto currency, the Parliamentary Standing

Committee on Finance on Monday discussed the same with industry experts,

association heads and stakeholders.

After listening to the

stakeholders' views, the majority of the members were of the opinion

that the advent of digital currency is inevitable but it cannot go ahead

without regulation, sources said.

The Parliamentary panel,

headed by former Union Minister and BJP MP Jayant Sinha met to discuss

'Hearing of views of Associations/Industry experts on the subject

'Crypto Finance: Opportunities and Challenges.'

Over the last few

years, even as scores of private establishments have offered it as an

attractive investment option, hundreds and thousands of Indians have

invested in the highly volatile crypto currencies, a market which is not

yet regulated. Newspaper advertisements and enticing audio-visuals on

television and OTT platforms are constantly streamed to capture newer

markets. This has put common investors' money at high risk.

This is the first such meeting on the subject.

The

discussion led to a consensus that there is a need to have a regulator

and there is a need of a regulatory mechanism for the same. However, as

this is an emerging field, there was no clarity as to who or which

department should be regulating it, sources said.

"The government

representatives have been asked to appear before the panel and address

the concerns raised by the Parliamentary panel," the sources said.

On

Saturday, when the Prime Minister chaired a high level meeting on the

subject, two top concerns flagged over-promising and lack of

transparency as this can lead to terror financing through money

laundering.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹88.70

|

₹87 |

UK Pound

|

₹119.90

|

₹116 |

Euro

|

₹104.25

|

₹100.65 |

| Japanese

Yen |

₹59.20 |

₹57.30 |

| As on 30 Oct, 2025 |

|

|

| Daily Poll |

|

|

| Who do you think will benefit more from the India - UK FTA in the long run?

|

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|