|

|

|

|

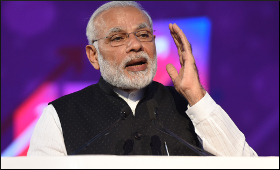

India has moved from tax terrorism to transparency: PM

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 11 Nov, 2020

Prime Minister Narendra Modi on Wednesday said that reforms in the

taxation system had made the country move from tax terrorism to tax

transparency.

Speaking at the inauguration of the

office-cum-residential complex of Cuttack Bench of Income Tax Appellate

Tribunal (ITAT), Modi said that the change had come due to the approach

of "reform, perform and transform".

He said that rules and procedures are being reformed with the help of technology.

"We are performing with clear intentions and at the same time transforming the mindset of the tax administration," he said.

The

Prime Minister said that when the difficulties of the country's wealth

creators are reduced, they get protection, then their trust grows in the

country's systems.

He added that the result of the growing trust

were that more and more partners were coming forward to join the tax

system for the development of the country.

Modi said that along

with the reduction in taxes and simplicity in the process, the biggest

reforms carried out are related to the dignity of honest taxpayers, to

protect them from trouble.

He also said that the thought process

in the government was to trust the income tax return completely at first

after it was filed. As a result of this, 99.75 per cent of the returns

filed in the country today were accepted without any objection.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|