|

|

|

|

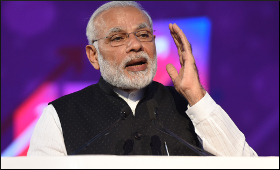

India right place to be, Modi tells investors

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 05 Nov, 2020

Prime Minister Narendra Modi on Thursday urged global investors to

invest in India and said that the country is the right place for

investments as it provides business returns and demand along with

reliability and the values of democracy.

Addressing the Virtual

Global Investor Roundtable, the Prime Minister laid down the reform

measures taken up by the government amid the pandemic along with the

steps announced during the past six years.

"If you want returns

with reliability, India is the place to be. If you want demand with

democracy, India is the place to be," he said.

"If you want

stability with sustainability, India is the place to be. If you want

growth with a green approach, India is the place to be," he added.

Highlighting

the country's democracy and demography, Modi said that India offers

investors democracy, demography, demand as well as diversity.

"Such

is our diversity that you get multiple markets within one market. These

come with multiple pocket sizes and multiple preferences. These come

with multiple weathers and multiple levels of development," he said.

Modi also said that the government would take every step necessary to make India lead the recovery of global economic growth.

"A

strong and vibrant India can contribute to the stabilisation of the

world economic order. We will do whatever it takes to make India the

engine of global growth resurgence," he said.

He also talked

about the recent reforms in the agriculture sector, which along with

accolades from several sector experts and economists have also faced

protests from farmers in several states.

Modi said that the

recent reforms in agriculture has opened up new possibilities for global

investors to partner with the farmers of India. He further said that

with the help of technology and modern processing solutions, India will

soon emerge as an agriculture export hub.

On the government's

vision of 'Aatmanirbhar Bharat', he said that India's quest to become

sel-reliant is "not just a vision, but a well-planned economic

strategy".

He described it as a strategy that aims to use the

capabilities of our businesses and skills of Indian workers to turn the

country into a global manufacturing powerhouse.

The Prime

Minister also said that through the year, India has "bravely fought" the

global pandemic and the world saw India's "national character".

The

global institutional investors present at the roundtable represented

key regions including the US, Europe, Canada, Korea, Japan, Middle East,

Australia and Singapore. Some of these included funds like Singapore's

Temasek Holdings, Canadian Investment Fund, Korean funds, JBIC, and

Australian Super, among others.

Ratan Tata, Mukesh Ambani, Nandan

Nilekani, Deepak Parekh, Uday Kotak and Dilip Sanghvi were the major

Indian business personalities present at the roundtable.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|