|

|

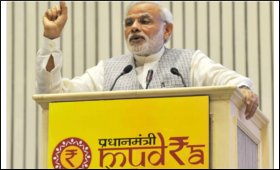

Mudra Yojana transforming lives, tweets Modi

|

|

|

|

| Top Stories |

|

|

|

|

Saurabh Gupta | 05 Oct, 2017

Pradhan Mantri Mudra Yojana under the Micro Units Development and Refinance Agency (MUDRA) Bank is transforming lives, Prime Minister Narendra Modi tweets on social media site on Wednesday.

The objective Mudra scheme is to fund and promote microfinance institutions, which would in turn provide loans to micro and small businesses. It is expected that 5.77 crore Small and Medium enterprises (SMEs) in the country will benefit from this scheme, which in turn will bring a sea change into the economy and the business ecosystem in the country.

In his tweet PM said that till now total 2,63,40,752 new enterprises

have been added under Mudra Yojana. In the year 2015-16 it was

1,24,74,668 and in 2016-17 it was 99,89,470 while in 2017-18 38,76,614

new enterprises were added till now, said PM Modi while speaking at an

event held to celebrate the inauguration of Golden Jubilee Year of the

Institute of Company Secretaries (ICSI) in Delhi.

On this occasion, The Prime Minister said that as a result of the efforts of the Government, the economy is functioning with less cash. The cash to GDP ratio has come down to 9 percent, from 12 percent before demonetization. The Prime Minister cautioned against people who only wish to spread a feeling of pessimism. The Prime Minister recounted instances in the past when the growth rate had fallen below 5.7 percent, witnessed in the last quarter. He said that low growth rates, on those occasions, had been accompanied by higher Inflation, higher Current Account Deficit and higher Fiscal Deficit.

The Prime Minister said that there was a time when India was considered to be part of the Fragile Five economies, which were dragging back global recovery.

Acknowledging the decline in growth in the previous quarter, the Prime Minister said that the Government is committed to reversing this trend. He said several important reform related decisions have been taken and this process will continue. He asserted that the country's financial stability will be maintained. He assured the gathering that the steps taken by the Government will take the country to a new league of development in the years to come. He said that a premium would be placed on honesty, and the interests of the honest would be protected.

The Prime Minister outlined the massive increase in investment and outlays in some key sectors over the last three years. He said that 87 reforms have been carried out in 21 sectors in this period. He presented figures to show the quantum jump in investment.

The Prime Minister said that in the policy and planning of the Government, care is being taken to ensure that savings accrue to the poor and the middle class, even as their lives change for the better.

The Prime Minister asserted that as he works to empower the people and the nation, even though he faces criticism on some occasions, he cannot mortgage the country's future, for his own present.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|