|

|

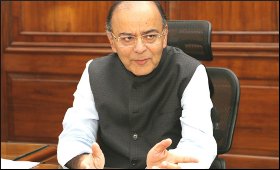

Hoping to implement GST from July 1: Jaitley

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 22 Mar, 2017

Finance Minister Arun Jaitley said on Wednesday that the government was

hoping to implement the Goods and Services Tax (GST) by July 1 after the

enabling Bills get Parliament's nod in the current budget session.

"GST

is the biggest reform in India. Hopefully, GST will be implemented by

July 1. GST Bills will hopefully be cleared in Parliament," Jaitley said

here at the 23rd Conference of Auditors General of Commonwealth Nations

hosted by the Comptroller and Auditor General (CAG) of India.

Jaitley

said that India's indirect taxation regime, which is currently the most

complex in the world, will transform into a simplified one with the

implementation of GST.

"We have the most complicated indirect tax

systems. Once implemented, what is currently the most complicated

system in the world will become the simplest in the world. The enabling

laws are before the Parliament. By middle of the year (2017), we hope to

see the implementation of GST," he said.

"Evasion of taxes will be difficult under GST. Size of Indian economy will increase," he added.

Jaitley also noted that India is an open economy with 90 per cent of the investment happening through the automatic route.

"Opposition

to reforms is minimal. Opposition to protectionism is minimal. Reforms

in the foreign direct investment (FDI) in India have been significant

and we are among the most open economies in the world," he said.

The

Finance Minister, however, lamented that while public investment and

FDI were high, private sector investment still lagged behind.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|