|

|

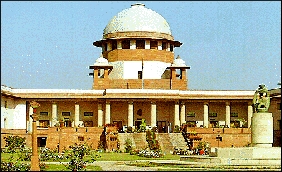

Consider more time for changing old notes: SC

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 05 Jul, 2017

The Supreme Court on Tuesday asked the Central government and the RBI to

consider, within two weeks, the option of granting time to people with a

legitimate reason for not being able to deposit old Rs 500 and 1,000

notes after these were demonetised.

A bench of Chief Justice J.S.

Khehar and Justice D.Y. Chandrachud asked Solicitor General Ranjit

Kumar, appearing for the Central government, to take instructions on the

issue and inform the court.

Ranjit Kumar sought time to get

instructions for granting an opportunity to persons to deposit their

money on a case-by-case basis.

The bench said there are people

who could not deposit their old currency note during the December 30

deadline - like those in prison.

"We want to know as to why you chose to bar such persons," it asked.

The

court was hearing a batch of petitions, including a woman who said she

had just delivered a baby and another who said she was dealing with a

death in her family.

The pleas sought direction to authorities to allow them to deposit demonetised notes.

On

November 8, 2016, the Central government had announced that Rs 500 and

Rs 1,000 notes would no longer be legal tender from November 9.

The

government had assured the people that demonetised currency notes could

be exchanged at banks, post offices and Reserve Bank of India (RBI)

branches till December 30, 2016. If people were unable to deposit them

by that day, they could do so till March 31, 2017 at RBI branches after

complying with certain formalities.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|