|

|

PM launches MUDRA bank for SMEs with Rs. 20000 cr corpus

|

|

|

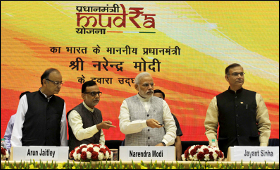

| The Prime Minister, Narendra Modi launching the Pradhan Mantri MUDRA Yojana, in New Delhi on April 08. |

| Top Stories |

|

|

|

|

SME Times News Bureau | 08 Apr, 2015

Prime Minister Narendra Modi on Wednesday launched a bank - MUDRA (Micro Units Development and Refinance Agency) with a corpus of Rs. 20,000 crore to extend credit of up to Rs.10 lakh to small and medium enterprises (SMEs) and regulate micro-finance institutions, to promote their growth, add to the country's output and create jobs.

The move is aimed at benefiting some 58 million small businesses in the country, who account for a mere four percent of institutional funding, despite employing over 120 million people, many from unprivileged strata of society, the officials said.

"After 'banking the un-banked' with the Jan Dhan Yojana, it's time to 'fund the unfunded'," the prime minister said at an event to launch what is called Micro Units Development and Refinance Agency - Mudra.

"Mudra is our innovation of funding the unfunded," the prime minister said.

"Millions of common men and women in this country, who run small businesses, have almost remained outside the net of formal institutional finance, in spite of their large contributions to the economy," he said at the event, attended, among others by Finance Minister Arun Jaitley.

"Providing access to institutional finance to such micro and small business units and enterprises will not only help in improving the quality of life of these entrepreneurs, but also turn them into strong instruments of growth and employment generation," the finance ministry said.

The initiative will also lay down the norms for responsible financing practices for micro-finance institutions so that the small businesses do not face hardship over indebtedness, while getting a fair environment for repayment.

In his budget speech delivered on February 28, the finance minister had said that while are were 5.77 crore small businesses in India, mostly individual proprietorships, these bottom-of-the-pyramid entrepreneurs found it difficult, if not impossible, to access formal systems of credit.

"I, therefore, propose to create a Micro Units Development Refinance Agency (Mudra) Bank, with a corpus of Rs.20,000 crore and a credit guarantee corpus of Rs.3,000 crore. Mudra Bank will refinance micro-finance institutions through a Pradhan Mantri Mudra Yojana," he added.

"These measures will greatly increase the confidence of young, educated or skilled workers who would now be able to aspire to become first generation entrepreneurs; existing small businesses, too, will be able to expand their activities."

|

SEE ALSO

|

| |

|

|

|

|

|

|

|

to set up a small enterprise of spices.

Chand Kr. Nath. | Thu May 7 04:29:50 2015

Hello my name is Chand kr.Nath,I want to start a SME regarding a spices unit. So I want to know how can I apply for the loan from MUDRA. What are its features n what is the rate of interest or any subsidy is available.

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|