|

|

Govt likely to announce new export sops today

|

|

|

|

| Top Stories |

|

|

|

|

Saurabh Gupta | 31 Jul, 2013

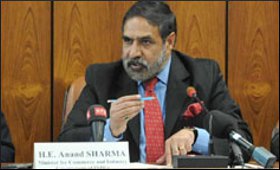

The government today is likely to announce new export incentives that could include steps to increase availability of credit and lower their cost, and other measures which Commerce and Industry Minister Anand Sharma had suggested when he met Prime Minister Manmohan Singh on Monday.

According to sources, some of the steps that could be on the cards include review of the Gold Card Scheme for extension of export credit, extension of swap facility to at least three years with an annual rollover, and including export finance under the priority sector advances for scheduled commercial banks, which were recommended by the RBI's Padmanabhan Committee panel.

On Tuesday, Chief Economic Adviser Raghuram Rajan had hinted that the export sector might get a new round of sops when he, in an official press statement, said that the government is exploring ways to reduce imports and incentivise exports in a bid to tame current account deficit.

Sharma, who is in a cabinet meeting at this moment, is expected to announce the new measures after the meeting.

Recently, exporters' body FIEO has demanded that the government should implement all the recommendations of the RBI panel in order to give the export sector a boost in the background of sluggish demand of Indian goods in global markets.

Some of the Padmanabhan Committee suggestions include review of Gold Card Scheme for extension of export credit to exporters, raising of foreign currency loans on pool basis for extension of export credit to exporters, more incentives in the area of taxation benefits and subvention, denomination of export credit limit in foreign currency, simplification of hedging procedure, etc.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|