|

|

|

|

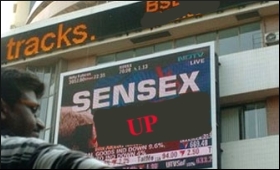

No Monday Blues: Sensex up over 1,200 points

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 23 Sep, 2019

Bull run in the domestic stock markets continued for the second straight day as the BSE Sensex rose over 1,200 points on Monday.

The

corporate tax cut rate announced on Friday that was dubbed as mother of

all measures to combat slowdown continued to boost the investor

sentiments.

At 12.37 p.m., the Sensex was trading at 39,271.39,

higher by 1,256.77 points or 3.31 per cent from the previous close of

38,014.62 points.

It has so far touched an intra-day high of 39,346.01 and a low of 38,674.04 points.

The

Nifty50 on the National Stock Exchange (NSE) was trading at 11,659.40,

higher by 385.20 points or3.42 per cent from its previous close.

Sitharaman

on Friday announced lowering of the corporate tax rate on domestic

companies to 22 per cent, subject to such entities not availing any

exemptions and incentives.

Also, these companies will not be

required to pay any Minimum Alternate Tax (MAT). Effective tax rate in

this case would be 25.17 per cent, including cess and surcharge.

Further,

the 'super-rich' tax will not apply on capital gains arising from the

sale of any security, including derivatives, in the hands of Foreign

Portfolio Investors (FPI).

To provide relief to listed companies

which have already made a public announcement of buyback before July 5,

2019, the government announced that tax on buyback of shares in case of

such companies shall not be charged.

These measures also boosted the investor sentiments in the market.

On

Friday, post the announcement, the Sensex advanced by a massive 1921.15

points to 38,014.62 and the broader Nifty jumped to 11,275.45 after

gaining 570.65 points, or 5.33 per cent.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|