|

|

|

|

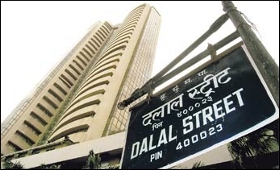

Sensex, Nifty flat, Yes Bank down 3%

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 21 Aug, 2019

The Sensex and Nifty on Wednesday traded on a flat note awaiting a stimulus package from the Union government.

The Sensex opened slightly lower at 37,298.73 from its Tuesday's close of 37,328.01.

At 10.07 a.m., the Sensex traded 59.02 points higher at 37,387.03 while the Nifty was up 13.75 points at 11,030.75.

Yes

Bank was trading 3.09 per cent lower during the early trade after

latest worry originating from a disclosure regarding irregularities and

unauthorised transactions at CG Power and Industrial Solution.

Yes Bank holds 12.8 per cent stake in CG Power, which hit lower circuit for the second straight day on Wednesday.

Besides,

the rupee continue to trade with weakness against the US dollar. The

rupee closed at over six-month low against the US dollar at 71.71 on

Tuesday.

Foreign Institutional Investors bought stocks worth Rs

373.23 crore on Tuesday while Domestic Institutional Investors purchased

scrips worth Rs 296.41 crore.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|