|

|

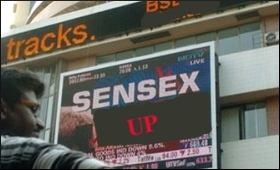

Global factors weigh heavy on markets

|

|

|

|

| Top Stories |

|

|

|

|

Sme Times News Bureau | 27 Nov, 2014

The Indian equities market consolidated amidst low volumes and liquidity to post a marginal loss of 0.47 percent for the week ended Dec 26 during the truncated weekly trade session.

Global pressures and lack of any positive local cues led bearish sentiments in the Indian equities market.

The dollar's strengthening post robust US GDP numbers and the crude’s free fall attracted the foreign investors to ship out funds.

Analysts pointed out that the markets will look for key reform announcements ahead of the 2015 Union budget and continue to expect more reforms and rate cut.

The benchmark Sensex was down marginally by 0.47 percent or 130.06 points in the week ended Dec 26 from its previous weekly close on Dec 19. The index closed at 27,241.78 points, while it had ended trade at 27,371.84 points on Dec 19.

In the week ended Dec 19, the Sensex had declined by 0.07 percent or 21.16 points from its previous weekly close on Dec 12. The index closed at 27,371.84 points, while it had ended trade at 27,350.68 points on Dec 12.

"With the cabinet's approval of the coal and insurance bills, we believe domestic factors and low inflation numbers would provide support to the markets in the medium term," said Vinod Nair, Head - fundamental research, Geojit BNP Paribas.

"The long two months ahead of the 2015 Union budget announcement may keep markets on the edge, but expectations over reforms and rate cut would continue to remain supportive."

For the week ended Dec 26, the FPIs sold stocks in equity markets worth Rs.1,472.16 crore or $454.18 million, according to data with the National Securities Depository Limited (NSDL).

In the week ended Dec 19, the FPIs had shipped out funds worth Rs.4,838.86 crore or $765.34 million.

The foreign institutional investors (FIIs) along with sub-accounts and qualified foreign investors have been clubbed together by market regulator Securities and Exchange Board of India (SEBI) to create a new investor category called FPIs.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|