|

|

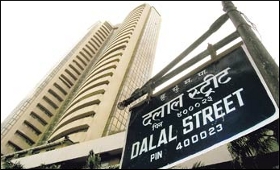

Sensex closes 148 points higher

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 17 Jun, 2013

The Bombay Stock Exchange benchmark index, Sensex, Monday rose 148 points on buying by funds mainly in auto, capital goods, and consumer durables stocks.

The Sensex gained by 147.94 points, or 0.77 percent, to 19,325.87 even as the RBI kept interest rates unchanged.

It touched a high of 19,344.28 and a low of 19,084.68 in trade today.

Similarly, the National Stock Exchange index Nifty rose by 41.65 points, or 0.72 percent, to 5,850.05 led by auto stocks.

It touched a high of 5,854.90 and a low of 5,770.25 in trade today.

Barring metal, all the sectoral indices closed with gains up to 1.90 percent.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|