|

|

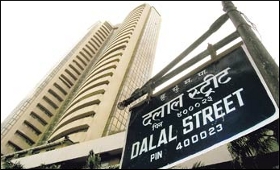

Markets end in red; Sensex down 65 pts

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 04 Jun, 2013

A benchmark index of the equities markets Tuesday closed down by nearly 65 points to hit a new one-month low on selling pressure.

The 30-scrip sensitive index (Sensex) of the S&P Bombay Stock Exchange (BSE) fell by 64.70 points, or 0.33 percent, to 19,545.78. It had lost 605 points in the last two sessions.

Similarly, the broad-based National Stock Exchange index Nifty closed lower by 19.85 points, or 0.33 percent, at 5,919.45.

Also, MCX-SX flagship index, SX40, ended down by 24.84 points, or 0.21 percent, at 11,610.07.

Out of the 30 BSE shares, 16 stocks declined led by Tata Motors, SBI and Jindal Steel, falling 2.34 percent, 2.11 percent and 1.98 percent to Rs 306.45, Rs 2,026 and Rs 284.85, respectively.

However, drug majors Dr Reddy's and Cipla bucked the general weakening trend and rose by 1.88 percent and 1.83 percent to Rs 2,152.85 and Rs 375.25, respectively. Dr Reddy's touched an intraday high of Rs 2,168.50.

Sectorally, the Consumer durable sector index suffered the most by losing 1.34 percent to 7,516.86 followed by banking index by 0.95 percent to 14,048.54, realty index by 0.96 percent to 1,676.01 and auto index by 0.46 percent to 11,021.39.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|