|

|

|

|

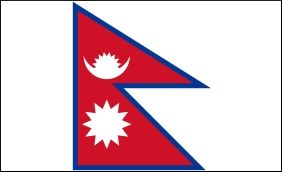

Rising inflation, Covid make people more vulnerable in Nepal

|

|

|

|

| Top Stories |

|

|

|

|

IANS | 23 Jan, 2022

Many families in Nepal are struggling due to reduced job

opportunities and growing inflation amid the Covid-19 pandemic, which

is still continuing unabated and has increased the single-day cases to

more than 10,000 in the past few days.

The monthly consumer price

inflation climbed to 7.11 per cent in December 2021, the highest in 64

months, from 5.32 per cent in November, according to data from the

country's central bank.

As a result, the prices of edible oil and

ghee had surged year on year by 28.52 per cent, followed by pulses and

legumes at 11.79 per cent, and tobacco products at 11.74 per cent,

reports Xinhua news agency.

In terms of the wholesale price

index, wood and wood products saw the highest price rise of 26.35 per

cent, followed by fuel and power at 22.27 per cent, and construction

materials at 19.34 per cent.

Experts have said that rising

inflation has been affecting the lives of the general people badly at a

time when they are suffering from unemployment and less income.

"The

biggest impact of higher inflation is on the daily wage earners and

those with fixed incomes," said Prakash Kumar Shrestha, chief of the

economic research department at the central bank.

"As inflation

contributes to a fall in the purchasing power of people, it has affected

the livelihoods of many downtrodden people."

The experts have

blamed the rising inflation in Nepal on supply chain disturbance, high

petroleum prices, increasing transport fares and shipping charges.

The South Asian country relies heavily on imported goods, particularly those from neighbouring India.

Nepal's

imports reached as high as 838.4 billion NPR ($7 billion) in the first

five months of the current fiscal year that began in mid-July last year

and around 60 per cent were from India, according to the central bank

figures.

For the last fiscal year, the average annualized

inflation was 3.6 per cent, which was lower "because of suppressed

demands due to lockdowns, which led to the closure of markets", said

Shrestha.

Experts said that they were expecting the inflation to

grow in the next few months after the country further increased the

prices of petroleum products in the past week, and that a possible

depreciation of the Nepali currency against the dollar may also

contribute to increasing prices of imported goods.

In November

last year, the central bank's inflation expectation survey showed that

most people expected the average prices of goods and services to rise by

a staggering 11.3 per cent for a year.

"One factor that could

contribute to further rise in inflation in the days to come is the

proposed elections in 2022," said Puspa Lal Shakya, an economics

scholar.

"Political parties and their candidates shall spend

heavily to win elections, creating more demands for goods and services

and contributing to a rise in inflation."

Nepal will hold local, provincial and federal elections in 2022.

Experts,

however, have not ruled out the possibility of inflation being tamed

due to a slump in demands over possible lockdown and more restrictive

measures to control the spread of the coronavirus.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|