|

|

|

|

'Economic offenders choose vulnerable targets looking to make a quick buck'

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 24 Nov, 2020

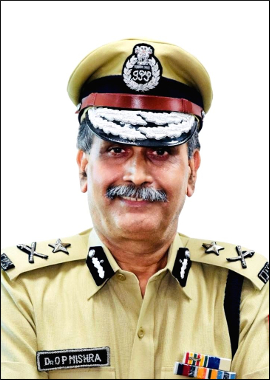

From Housing scheme frauds to ponzi scheme frauds , white collar crime

has been evolving new modus operandi to dupe people across the country.

This amplifies the role of Economic Offences Wing of the Delhi Police to

identify and arrest the accused after going through the digital

footprints of fraudsters. In an exclusive interview with IANS Special

Correspondent Zafar Abbas, Joint Commissioner of Police EOW O.P. Mishra

elaborates on the new modus operandi of the criminals and precautions

one can take to shield oneself from financial fraud.

In the

present scenario, do you think the role of the EOW has enhanced manifold

as more and more people are falling to the tricks of fraudsters and

losing money as white collar crimes rise?

O.P. Mishra: Yes, the role of

Economic Offences Wing has enhanced manifold. Economic offences are of

different kinds. Offenders choose individual as well as collective

victims. They accordingly adopt different methodologies and tricks to

attract victims in their net.

From ponzi schemes to land pooling frauds, what are the recent modus operandi of the fraudsters to dupe people?

O.P. Mishra: Land pooling has recently emerged as a fraud in which innocent

investors were motivated to invest in various housing schemes such as

under the proposed land pooling policy of the DDA. The ground reality is

that, DDA has yet not formally announced or finalised the comprehensive

land pooling policy for different areas of Delhi. In anticipation of

the scheme, many societies were formed by unscrupulous persons

motivating people to invest. These societies are not in possession of

any land duly approved by the DDA or the Real Estate Regulatory

Authority (RERA). We have registered more than 19 cases against various

fake societies. Similarly, ponzi scheme is a lucrative financial scheme

floated by unauthorised people with a promise of very high returns on

investment. Ponzi schemes operate under various guises. The EOW has

recently arrested several people in various ponzi scheme cases.

Do you think the EOW is well-equipped to handle the influx of white

collar Crime cases or there is need for upgrade regarding manpower and

other facilities?

O.P. Mishra: Yes, the Economic Offences Wing, Delhi

Police is well-equipped to handle the influx of white collar crime

cases. The professional skills of the Investigating Officers are

constantly upgraded through internal refresher courses and specific

crime-based interaction with known experts in that field. Investigating

Officers have acquired required professional skills for handling

specific nature of cases. The unit has also been able to equip itself

technologically over a period of time. Various other technological

initiatives are under various stages of implementation.

How easy or how difficult is the recovery of money in crimes involving crores of rupees after the accused is arrested?

O.P. Mishra: The investigation of economic offences is heavily document-based. It

requires lot of scrutiny and verification of documents related to the

nature of offence committed. As per our investigative protocol, the bank

accounts of alleged persons are immediately frozen after registration

of the case. However, recoveries in various crimes take place through a

legal protocol on the orders of the competent court. In a recent case of

housing fraud, the builder was forced to return the money of various

investors by the order of the court immediately after arrest.

What advice would you give to the general public so that they don't get trapped by the schemes of fraudsters?

O.P. Mishra: Every crime takes place because of certain lapses on the part of the

victims. This is very much true for economic offences. Economic

offenders choose vulnerable targets who are looking to make quick money

in a very short span. I would like to advise people to invest in housing

schemes after proper verification of the site, credentials of the

company and due permission from the competent authority. Similarly,

people should not get tempted to invest simply on the basis of lucrative

and false incentives offered by the various companies without proper

verification. Several unauthorised non-banking financial companies are

operating. Investors have to be careful. A little bit of care and

scrutiny at the initial stage by the investor can save him/her from

becoming a victim of economic offence at later stage.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.2

|

₹89.5 |

UK Pound

|

₹123.35

|

₹119.35 |

Euro

|

₹107

|

₹103.35 |

| Japanese

Yen |

₹57.9 |

₹56.1 |

| As on 22 Jan, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|