|

|

|

|

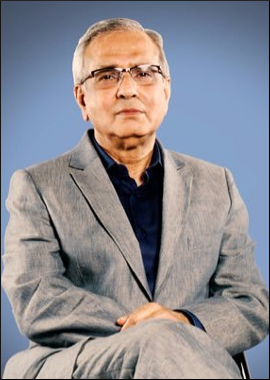

Rate cut positive step, H2 growth likely to be better: Rajiv Kumar

|

|

|

|

| Top Stories |

|

|

|

|

Anjana Das | 22 Oct, 2019

The Reserve Bank of India has done a good job with the latest rate cuts

of 25 bps and along with the recent fiscal measures taken by the

government, the second half growth is likely to be much better, Niti

Aayog Vice chairman Rajiv Kumar said on Friday.

"RBI has done a

good job, it will absolutely add to the already taken growth

initiatitives of the government. We hope the RBI decision on repo rate

cut is going to create consumption demands during the festival time.

Lets see how it works out," Kumar told IANS in an exclusive interview.

The

government think tank feels the second half of the fiscal (Oct-March)

is expected to be better with RBI's lower repo rates, including Friday's

and the host of fiscal steps taken by the government.

"I think

the higher Q2 and Q3 growth estimates of the RBI (current fiscal from 5

per cent in Q1) are surely sustainable with today's cut (repo rate)

and on the back of a lot of fiscal support from the government. As far

as H2 growth is concerned which RBI has pegged it at 6.6 per cent - 7.2

per cent, I think we are on a higher growth trajectory (in H2) with all

support measures government has taken and now with RBI repo rate cut,

the second half will be much better than the first half.

If the

H2 growth rates becomes higher a bit more, it can of fset the lower

growth rate for the whole year (FY 20) as estimated by RBI a t 6.1 per

cent, down from 6.9 per cent," he said.

Kumar noted in the

current low growth scenario, if inflation and fiscal deficits are

tinkered with appropriately, should not be a concern.

"Inflation

even if it goes up a little bit but adheres to the range of RBI at 4

per cent, it is ok. Fiscal deficit is not really a concern at this

moment," he said.

The Reserve Bank of India on Friday cut

interest rates for the fifth time this year to kickstart the languishing

economy as it slashed the GDP growth projection for financial year

2019-20 to 6.1 per cent from the earlier forecast of 6.9 per cent.

RBI

has estimated 5.3 per cent for Q2, 6.6 per cent for Q3 and 7.2 per cent

for Q4, all higher than the Q1 growth though overall growth it has

slashed for the fiscal.

The Monetary Policy Committee in its

August meeting had already trimmed the GDP growth forecast for this

financial year to 6.9 per cent from 7 per cent with a downward bias.

On

Friday, GDP prediction for the first quarter of the upcoming financial

year was also reduced to 7.2 per cent from 7.4 per cent.

The

MPC noted that private final consumption expenditure slowed down to an

18 -- quarter low. The statement also stated that growth in the services

sector was stalled by construction activity.

The government has

also announced a series of measures, including steepest cut in

corporate tax, rollback of enhanced surcharge on Foreign Portfolio

Investors, among others to jump-start growth, which hit a six-year low

of 5 per cent during the first quarter of the current fiscal.

Retail

inflation in August accelerated to a 10-month high but remained well

below the RBI's medium-term target of 4 per cent for a 13th straight

month.

The RBI also cut its GDP growth estimates to 6.1 per cent, from earlier estimate of 6.9 per cent.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.25

|

₹89.55 |

UK Pound

|

₹122.85

|

₹118.85 |

Euro

|

₹107.95

|

₹104.3 |

| Japanese

Yen |

₹59 |

₹57.1 |

| As on 29 Dec, 2025 |

|

|

| Daily Poll |

|

|

| What is your biggest hurdle to scaling right now? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|