|

|

|

|

Govt, RBI discussing on allowing co-op banks to lend under ECLGS

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 11 Aug, 2020

As the Emergency Credit Line Guarantee Scheme, specially formed for

MSMEs, progresses, the government is considering allowing cooperative

banks to lend under it too.

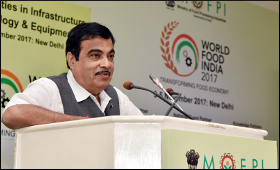

Addressing a webinar at the

'FICCI-SBI Atmanirbhar MSME Virtual Conclave', Micro, Small and Medium

Industries Minister Nitin Gadkari said that the government is discussing

the matter with the Reserve Bank of India (RBI).

"Cooperative

banks that are not included as a member lending institutions under the

Emergency Credit Line Guarantee Scheme (ECLGS) will be included as

lenders for MSMEs, under a scheme being discussed in consultation with

the RBI," a FICCI statement quoted Gadkari as saying.

He also

urged the states to release payments due to MSMEs within 45 days, as

"this will help bring liquidity, which will accelerate the economic

growth of the country".

Gadkari emphasised that special focus

towards export enhancement is the need of the hour, and there is also a

need to focus on import substitution to replace imports with domestic

production.

He also urged the industry to identify the sectors

heavily reliant on imports, particularly from China, and look for

substitutes towards indigenous production to make India self-reliant.

Gadkari

also said that the government aims to increase MSMEs' contribution to

the GDP to 50 per cent and in share of exports to 60 per cent, which

would help the sector create 5 crore jobs in the next five years.

"The

government is formulating a special policy to generate employment in

the rural areas and aims to increase the turnover of village industries

and encourage medium scale units such as ago and food processing

industries, handloom, and handicrafts," he said.

State Bank of

India Chairman Rajnish Kumar said that the advancement of digital

technology has revolutionised the process of lending to MSMEs as the

availability of data and technology in the form of analytics has made it

easier to automate lending decisions to the sector.

"We will be using the digital platform in a big way for lending," he said.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

₹91.35

|

89.65 |

UK Pound

|

₹125.3

|

₹121.3 |

Euro

|

₹108.5

|

₹104.85 |

| Japanese

Yen |

₹58.65 |

₹56.8 |

| As on 19 Feb, 2026 |

|

|

| Daily Poll |

|

|

| What is your primary "Make or Break" expectation from the Finance Minister this year? |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|