|

|

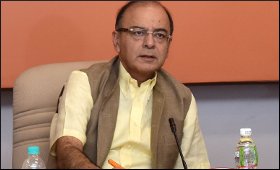

Jaitley hopes GST bill will be passed through consensus

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 29 Mar, 2017

Describing the Goods and Services Tax (GST) bill as "revolutionary",

Finance Minister Arun Jaitley on Tuesday hoped all the related bills

would be passed with consensus in the current budget session of

Parliament.

The bill will be discussed in the Lok Sabha on Wednesday.

Jaitley's

remarks came at the BJP parliamentary party meeting which was also

attended by Prime Minister Narendra Modi and other senior ministers.

"GST

bill is revolutionary and I hope that its passage will be ensured in

Parliament in the current Budget session," Parliamentary Affairs

Minister Ananth Kumar quoted Jaitley as saying.

Noting that

discussions on the GST Bill will take place in the Lok Sabha on

Wednesday, Ananth Kumar said that Jaitley briefed the Bharatiya Janata

Party MPs about the CGST, IGST, UT GST and GST Compensation Bills

introduced in the house on Tuesday and hoped that the bills would be

passed in the current session through consensus.

Ananth Kumar said passage of the GST Bill will benefit the people as well as economy.

India

moved a step closer to becoming a unified market with the tabling in

Parliament on Monday of the GST Bill, which extends across India except

Jammu and Kashmir.

Jaitley introduced the Central Goods and

Services Tax (CGST) Bill, 2017, along with three other related bills in

the Lok Sabha, providing for a maximum GST rate of 40 per cent, an

anti-profiteering authority and imprisonment for evading taxes.

The

GST regime will subsume various indirect levies of the Centre and

states like service tax, excise duty, octroi and value added tax (VAT),

and create an input tax credit chain for refunds.

The CGST Bill

will enable levy and collection of tax on intra-state supply of goods

and services or both by the central government.

The BJP

parliamentary party also congratulated Modi for setting up of new

commission replacing the existing National Commission for Backward

Classes (NCBC) and giving it constitutional status.

The BJP-led

National Democratic Alliance (NDA) approved a proposal to provide

constitutional backing to the National Commission for Socially and

Educationally Backward Classes (NSEBC).

Apart from GST, the

parliamentary party also discussed Congress leader and former Union

Minister M.V. Rajasekharan's letter showering praise on the Prime

Minister and former External Affairs Minister and Karnataka Chief

Minister S.M. Krishna leaving the Congress to join the party.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|