|

|

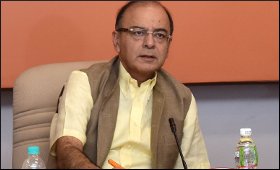

Competition between traditional, payments banks imminent: FM

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 13 Jan, 2017

Finance Minister Arun Jaitley on Thursday said the launch of payments

bank will now initiate competition between traditional banking and these

new banks.

"We will see competition not only among telecom

companies but between traditional banking and these new banks," Jaitley

said here at the launch of Airtel Payments Bank.

"Telecom

companies have built-in customer base. This business of banking is

incidental to their technology. It was a convergence waiting to happen,"

Jaitley added.

For telecom companies to get into this business is quite natural, he said.

The Reserve Bank of India gave the payments bank licences to 11 companies, of which 4-5 are telecom firms.

The payments banks will be an immediate addition to the existing bank structure, he added.

Jaitley said with the bulk of population becoming connected to the banking, the cost of transactions will become minimal.

"With

JAM (Jan-Dhan, Aadhar and Mobile) and increased digitisation, banking

costs are going to be minimal in the country," he said.

"Increase

in digitisation of economy would bring obvious gains to society.

Emerging generations of India are taking to newer technologies and

digitisaiton quite easily," he added.

Jaitley said that the next

revolution to happen is post offices turning into banks as they lie

under-utilised despite having a wide connectivity in rural areas.

He said "1.75 lakh post offices which are under-utilised, are waiting to be converted into banks. They have connectivity".

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|