|

|

Budget 2017-18: Announcements for MSME sector

|

|

|

|

| Top Stories |

|

|

|

|

Saurabh Gupta | 01 Feb, 2017

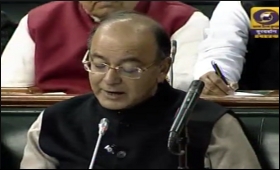

Union Finance Minister Arun Jaitley on Wednesday presented his fourth budget in the Lok Sabha. In his budget speech Finance Minister announces measures that will directly or indirectly benefit the micro, small and medium enterprises (MSMEs) of the country.

Finance Minister announces, 5 percent tax cut for MSMEs with turnover of Rs 50 cr. Corporate Tax Rate for MSMEs having Rs 50 cr turnover reduced to 25 percent. This will make MSMEs more competitive as compared to larger companies.

In his Budget Speech, Jaitley said, "In order to make MSME companies more viable and also to encourage firms to migrate to company format, I propose to reduce the income tax for smaller companies with annual turnover upto Rs 50 crore to 25 percent."

"As per data of Assessment Year 2015-16, there are 6.94 lakh companies filing returns of which 6.67 lakh companies fall in this category and, therefore, percentage-wise 96 percent of companies will get this benefit of lower taxation. This will make our MSME sector more competitive as compared to large companies. The revenue forgone estimate for this measure is expected to be Rs 7,200 crore per annum," he added.

FM reduces presumption tax rates for units with Rs 2 crore turnovers to 6 percent. He said, "There is a scheme of presumptive income tax for small and medium tax payers whose turnover is upto Rs 2 crores. At present, 8 percent of their turnover is counted as presumptive income. I propose to make this 6 percent in respect of turnover which is received by non-cash means. This benefit will be applicable for transactions undertaken in the current year also."

To promote digital transaction among MSMEs, FM said, "Increased digital transactions will enable small and micro enterprises to access formal credit. Government will encourage SIDBI to refinance credit institutions which provide unsecured loans, at reasonable interest rates, to borrowers based on their transaction history."

FM double the landing target for MUDRA. He said, "The Pradhan Mantri Mudra Yojana has contributed significantly to funding the unfunded and the underfunded. Last year, the target of Rs 1.22 lakh crores was exceeded. For 2017-18, I propose to double the lending target of 2015-16 and set it at Rs 2.44 lakh crores."

Adding, "Priority will be given to Dalits, Tribals, Backward Classes, Minorities and Women."

Jaitley allocates more towards rural areas, welfare schemes and infrastructure, while ensuring that government finances do not go out of control.

The Finance Minister also outlined 10 themes for his latest exercise.

"My approach in preparing the budget is to spend more on rural areas, infrastructure and poverty alleviation with fiscal prudence," he added.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|