|

|

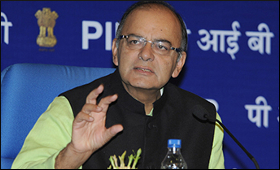

FM asks states to reduce VAT on petroleum products

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 18 Aug, 2017

Finance Minister Arun Jaitley on Friday urged states to reduce VAT on

petroleum products due to concerns regarding the rise in input costs due

to the transition to GST regime.

"The letter by Finance Minister

to Chief Ministers highlights the concern being raised by the

manufacturing sector," the Finance Ministry said in a statement.

The

industry had flagged concerns on increase in the cost of petroleum

products, used as inputs for manufacture of goods, due to cascading of

taxes.

In the pre-GST regime, because the petroleum products as

well as the final goods produced both attracted VAT, input tax credit of

petroleum products was allowed to varying extent by different states.

However,

in the post-GST scenario, the manufactured goods attract GST while the

inputs of petroleum products used in the manufacture attract VAT and,

therefore, it would lead to cascading of taxes.

In view of this,

in the pre-Goods and Services Tax regime certain states had lower rate

of 5 per cent VAT on Compressed Natural Gas (CNG) used for manufacturing

of goods.

Some states also had lower rate of VAT on diesel used by manufacturing sector.

"Thus,

Jaitley has requested other states also to explore the possibility of

having a lower rate of VAT on petroleum products used for manufacturing

of those items on which there is GST, so that there is minimum

disruption in the costing of goods," it said.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|