|

|

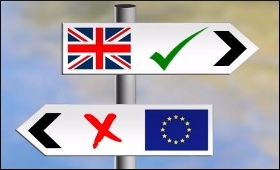

'No indication of financial crisis from Brexit'

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 28 Jun, 2016

US Treasury Secretary Jacob Lew has said there is no indication that Britain's referendum to leave the European Union (EU) would lead to another financial crisis.

"There's no question that this is an additional headwind, but I think that it is something that we can manage through and Europe and the UK can manage through," Lew said in an interview with CNBC on Monday, Xinhua news agency reported.

"You've seen policymakers act in a very responsible way in the days leading up to and through the vote. There's no sense of a financial crisis developing."

While global stock market tumbled sharply and the British pound plunged to a 31-year low against the US dollar following Britain's referendum result, Lew said the impact on the financial markets had been orderly so far.

"Obviously this is a change in policy that has implications which change the decisions investors make so I'm not saying there' s not an impact on the markets, but it's been an orderly impact so far," he said, noting that European banks are "better equipped" to deal with the Brexit than they would have been in 2008.

Following a decision to exit the EU, Britain would need to negotiate the terms of its withdrawal and a new relationship with the EU.

Lew said he expected to see a long period of change in Europe and a lot of attention would be paid to policies, actions and words used by policymakers.

"The more there's a focus on restoring confidence, the more there's a focus on maintaining conditions to promote growth, the better," he said, urging all the governments around the world to use all tools available, including fiscal policy, monetary policy and structural reforms, to promote economic growth in response to the Brexit.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|