|

|

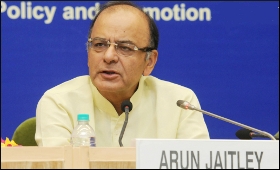

Markets need not panic, bank NPA being tackled: FM

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 12 Feb, 2016

Finance Minister Arun Jaitley on Friday said Indian banks were equipped well to deal with bad loans, and that markets need not panic since the current turmoil that has pulled down key stock indices in the country is driven by external factors.

"The media reports on bad position of public banks are not fully correct," the finance minister tweeted, a day after Reserve Bank of India Governor Raghuram Rajan also said the some claims by analysts on the issue were "wild" and verged on scare-mongering.

"Bad loan are there, but banks are equipped to deal with the issues. The government is committed to protect the banks and give them the capital requirements. The RBI is also giving guidance," the finance minister said.

"In the past few days there has a been a major sell off in markets. Obviously, this has created a chain reaction across the world. Indian markets are also being significantly impacted by this," he said, adding in India, however, there was an over-reaction.

"As a result of various international developments that are taking place, there need not be any exaggerated panic in India -- for the reason that Indian economy, even in the midst of a global slowdown has clearly stood out," he said, calling for a focus on the Indian economy's strength.

The comments also come against the backdrop of the sensitive index (Sensex) of the Bombay Stock Exchange (BSE) losing 1,665.14 points, or 6.76 percent, during the past four trading days ended Thursday, shaving Rs.6,73,192 crore out of the bourse's market capitalisation.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|