|

|

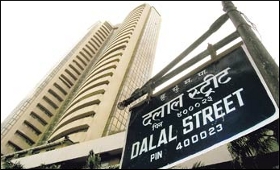

Falling Asian markets, macro data drowns Sensex

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 01 Sep, 2015

The slide in Asian markets, especially the continuous rout in Chinese

bourses and below-expected macro data sobered investor's sentiments and

sent the Indian equities markets plunging on Tuesday.

The barometer 30-scrip sensitive index (Sensex) of the Bombay Stock Exchange (BSE)

tanked by 586.65 points or 2.23 percent at 25,696.44 points.

Bearish

sentiments were also witnessed at the wider 50-scrip Nifty of the

National Stock Exchange (NSE). It ended the day's trade at 185.45 points

or 2.33 percent down at 7,785.85 points.

The S&P BSE Sensex

which opened at 26,127.04 points, closed at 25,696.44 points, down

586.65 points or 2.23 percent from the previous day's close at 26,283.09

points.

The Sensex touched a high of 26,141.07 points and a low of 25,579.88 points during the intra-day trade.

Analysts

cited negative cues eminating out of Asian markets, especially the

continuous slide in the Chinese exchanges to be the catalyst for the

sharp fall in the domestic bourse.

"The sharp fall in the day's

trade and the high intra-day volatility were caused due to the bearish

cues coming in from the Asian markets. The investors are nervous about

the evolving situation in China and its apparent outcome which might be a

bigger challenge in the long run," Anand James, co-head, technical

research, Geojit BNP Paribas, told IANS.

"The volatility is also

being flared-up due to expectations of new measures by the Chinese

government and central bank to stabilise the markets. This might put

further pressure on the yuan and subsequently on the rupee value."

Among

the Asian markets, Japan's Nikkei plunged by 3.84 percent. Hong Kong's

Hang Seng plummet by 2.24 percent. China's Shanghai Composite Index

dropped by 1.28 percent.

The massive implosion in the Chinese

markets which has by some estimates eroded 40-45 percent of the entire

stock value coupled with yuan devaluation and lower factory out has

spooked the world markets.

Other factors which subdued the

markets were below-expected first quarter (Q1) gross domestic product

(GDP), eight core industries (ECI) and purchasing mangers index (PMI)

figures. All these macro data points were below market's estimates.

"Markets

are seeing a significant fall today led by the lower than expected GDP

growth and a global selloff on account of the weak Chinese PMI figures,

which slipped below the 50-mark in August indicating a contraction,"

Vaibhav Agrawal, vice president, research, Angel Broking told IANS.

The

Q1 GDP came in at 7 percent, showing signs of slowing vis-a-vis the 7.5

percent expansion in the quarter before. But the growth was much higher

than 6.7 percent registered in the first quarter of the last fiscal.

The

ECI for select factory output slowed to 1.1 percent growth in July from

an increase of 3 percent in the previous month, mainly due to a fall in

steel production and marginal growth in coal. The select factory output

index rose by 4.1 percent in July 2014.

The Nikkei India

Manufacturing PMI (Purchasing Manufacturers Index) for the last month

stood at 52.3 which is marginally down from July's 52.7.

An index reading of above 50 indicates an overall increase in the manufacturing sector, below 50 an overall decrease.

"Market

shut the day with severe cuts on the back of weak global and domestic

macro economic data. China’s weak PMI and India’s lower GDP growth

dampened the sentiments. Sell-off was mainly triggered by the banks

especially PSU banks on raising the concerns of pressure on their

margins," said Gaurav Jain, director with Hem Securities.

Sector-wise,

all 12 sub-indices of the BSE ended the day's trade in the red. The

S&P BSE banking, automobile, capital goods, consumer durables and

healthcare indices came under intense selling pressure.

The

S&P BSE banking index plunged by 713.55 points, the automobile index

receded by 472.84 points, the capital goods index contracted by 442.05

points, the consumer durables index declined by 272.67 points and

healthcare index decreased by 263.78 points.

Major Sensex gainers during Tuesday's trade were: Sun Pharma, up 0.34 percent at Rs.900.75.

The

major Sensex losers were: Axis Bank, down 5.24 percent at Rs.480.15;

Hindalco Industries, down 5.18 percent at Rs.75.90; Tata Steel, down

3.93 percent at Rs.216.20; BHEL, down 3.91 percent at Rs.217.65; and

Vedanta, down 3.80 percent at Rs.94.85.

In Europe, London's FTSE

100 index rose by 0.90 percent, French CAC 40 tumbled by 0.50 percent

and Germany's DAX Index slipped by 0.43 percent at close of trading

here.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|