|

|

Fiscal deficit due to increased tax refunds: FM

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 01 Nov, 2014

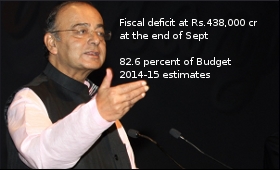

The higher fiscal deficit in the current financial year, that has touched 83 percent of the full year's target, is the result of increased tax refunds, Finance Minister Arun Jaitley said Friday.

"Higher tax refunds are getting reflected in fiscal deficit number. This year there were pending tax refunds estimated around Rs.120,000 crore," he told reporters in New Delhi.

"It would be challenging to achieve the indirect tax aim. Direct tax target would be achievable. We would strive to achieve fiscal deficit aim for this fiscal," he added.

The fiscal deficit at Rs.438,000 crore at the end of September has touched 82.6 percent of Budget 2014-15 estimates, as per official data. The deficit for the entire year has been pegged at Rs.531,000 crore, equivalent to 4.1 percent of GDP.

During the period April-Oct 20 period, the income tax department has made refunds worth Rs.80,850 crore.

The government aims to collect Rs.736,000 crore from direct taxes in the current fiscal, whereas it had collected Rs.636,000 crore last year.

Net tax receipts in the first half of 2014-15 stood at Rs.323,000 crore.

The indirect tax target for this fiscal is to collect around Rs.624,000 crore, which is over 20 percent more than that collected last year.

Earlier, addressing the first meeting of the consultative committee attached to his ministry, Jaitley said the major priority of the government is to bring back the growth momentum.

He enumerated the steps taken to boost growth, which include setting-up the Expenditure Management Commission for expenditure reforms, extension of the 10-year tax holiday for power projects, reduction and rationalization of excise duty, promoting FDI in selected sectors and the deregulation of diesel prices.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|