|

|

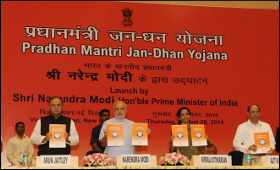

Modi launches Jan Dhan Yojana, record 15 mn bank accounts opened

|

|

|

|

| Top Stories |

|

|

|

|

SME Times News Bureau | 29 Aug, 2014

Prime Minister Narendra Modi Thursday launched the union government's flagship financial inclusion scheme "Pradhan Mantri Jan Dhan Yojana" (PMJDY), with the national rollout leading to the opening of an astounding 15 million bank accounts on a single day.

Modi said the project, launched in a mission mode, aims at tackling poverty by ending "financial untouchability".

Under the project announced by Modi during his Independence Day address, bank accounts and debit cards with an accident insurance cover of Rs.1 lakh will be provided to millions still without access to formal banking facilities.

With the government having done extensive homework for the project's rollout, Modi took pride in the numbers that exceeded the target set for the day.

"Never before would insurance companies have issued 1.5 crore (15 million) accident insurance policies in a single day. Never before in economic history would 1.5 crore bank accounts have been opened in a single day," Modi said.

The figure is close to the population of the Netherlands.

"Never before has the government organised a programme of such scale - over 77,000 locations - with the participation of so many chief ministers, union ministers and officials. The success is an inspiration for achieving new heights," Modi added.

"If Mahatma Gandhi worked to remove social untouchability, if we want to get rid of poverty, we have to get rid of financial untouchability. We have to connect every person with the financial system," he said.

Referring to the bank nationalisation of 1969, Modi said it was done with the avowed objective of spreading the reach of financial system to the poor.

"But that objective had not been achieved till date. After 68 years of independence, not even 68 percent of India`s population had access to banking," he added.

Modi described the occasion as a festival to celebrate the liberation of the poor from a poisonous cycle.

He said the scheme was declared Aug 15. "It has been implemented in 15 days and 1.5 crore people have been enrolled in a single day," he added.

Modi said there would be an additional Rs.30,000 life assurance cover for those opening bank accounts before Jan 26, 2015.

The prime minister said the nationwide success of the enrollment drive would give confidence to government departments about achieving their targets.

Modi had written a mail to over seven lakh bank employees exhorting them to help reach the targets set for financial inclusion of the poor.

He said a breakthrough was required to overcome the vicious cycle of poverty and debt and it was achieved Thursday.

Bank officials said the people were provided zero-balance accounts.

A film on "Financial Inclusion" was screened, the prime minister unveiled a logo and a 'mission document' on financial inclusion.

He also dedicated a mobile banking facility on basic mobile phones to the nation.

In fact, the overwhelming first-day success led Finance Minister Arun Jaitley, present on the occasion, to revise the earlier time-table for the PMJDY.

The Phase I of the scheme, wherein 75 million account holders were to be enrolled by Aug 14, 2015, has been brought forward to Jan 26, 2015, Jaitley announced.

The second phase, wherein an overdraft of Rs.5,000 will be provided to each account holder, will now commence from Republic Day, Jan 26, 2015.

"This whole exercise is aimed at lifting the poor out of the poverty line. After today's breakthrough momentum, I don't think it (Jan Dhan Yojana) will stop," Modi said.

The Indian industry welcomed the launch of the financial inclusion scheme to empower the poor.

"It is an innovative and much needed step in the right direction which will address the biggest national challenge, that is, eradication of poverty, through financial inclusion," Confederation of Indian Industry (CII) director general Chandrajit Banerjee said in a statement.

"This will also allow the government to transfer the subsidy benefits directly to the end consumer which will help in plugging the leakages occurring in the current system," he added.

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Customs Exchange Rates |

| Currency |

Import |

Export |

US Dollar

|

66.20

|

64.50 |

UK Pound

|

87.50

|

84.65 |

Euro

|

78.25

|

75.65 |

| Japanese

Yen |

58.85 |

56.85 |

| As on 13 Aug, 2022 |

|

|

| Daily Poll |

|

|

| PM Modi's recent US visit to redefine India-US bilateral relations |

|

|

|

|

|

| Commented Stories |

|

|

|

|

|

|

| |

|